Bratislava: SiltaNews – News Desk

Slovakia’s energy sector is experiencing a challenging time, caused by restrictions on oil and gas purchases from Russia, growing pressure to develop renewable sources, and the impact of high emissions allowance prices. Despite this, energy companies achieved record revenues and profits last year, confirming that they are among the most profitable businesses in the country.

Electricity Leads the Way

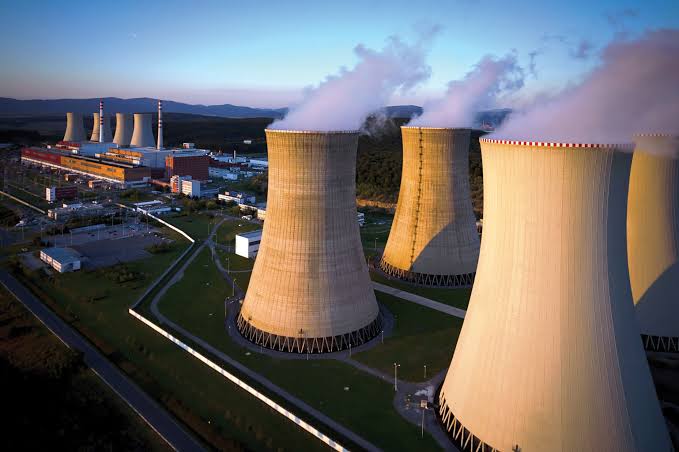

Slovenské Elektrárne (SE) is the largest producer of electricity in Slovakia and, for the second year in a row, after bringing the long-awaited third unit of the Mochovce nuclear power plant into operation in 2023, also the most profitable company in the country. Thanks to its nuclear generation, Slovakia can now cover all domestic electricity consumption and export the surplus.

From a loss of €217 million on revenues of almost €5 billion in 2022, SE swung to a profit of €558 million on revenues of almost €4 billion the following year. Last year, 2024, was even more successful for the company, which is co-owned by the state, Italy’s Enel, and Czech tycoon Daniel Křetínský. Preliminary figures show a net profit of around €800 million. The company’s revenues were boosted by the previous years’ higher electricity prices, which fed into multi-year contracts, the Trend weekly pointed out.

Oil and Gas Adaptation

Slovnaft, the Bratislava-based refinery owned by Hungary’s MOL Group, remained one of Slovakia’s most profitable firms despite the EU’s restrictions on Russian crude imports. By diversifying supply sources and investing in refining flexibility, Slovnaft managed to sustain strong margins, though profits moderated compared to the extraordinary levels of 2022.

Distribution and Grid Stability

Regional distributors such as Západoslovenská energetika (ZSE) posted solid profits thanks to regulated tariffs and steady demand. Grid operators benefited from higher connection fees as Slovakia expanded renewable projects, particularly solar. However, they face mounting investment needs to modernize infrastructure for the energy transition.

Renewables on the Rise

Slovakia’s renewable share remains modest compared to EU averages, but solar capacity doubled in 2024, driven by subsidies and falling panel prices. Hydropower continues to play a role, though expansion potential is limited. Policymakers are under pressure to accelerate wind projects, which have faced local opposition.

Emissions and EU Policy Pressure

High emissions allowance prices under the EU ETS weighed heavily on coal and gas plants, reinforcing the dominance of nuclear and renewables in Slovakia’s energy mix. The government is considering additional support schemes to help industries cope with carbon costs.

Profitability Rankings

According to Trend weekly’s ranking, energy companies dominated the list of Slovakia’s most profitable firms in 2024. SE led with €800 million net profit, followed by Slovnaft and major distributors. The sector’s profitability contrasts with the broader Slovak economy, where many industries struggled with inflation and weaker demand.

Outlook

Analysts expect profits to normalize in coming years as electricity prices decline from their 2022–2023 peaks. Nuclear power will remain Slovakia’s backbone, but the energy transition will require heavy investment in renewables, grids, and storage. The government faces the challenge of balancing affordability for households with the need to meet EU climate targets.